The comparison of Hybrid vs Electric Cars in Japan highlights a major shift in the Japan’s automotive industry, as it balances its well-established hybrid technology with the worldwide move toward full electrification. Well-known for its innovation and environmental commitment, Japan stands out as a model of sustainable transportation. By 2024, hybrid (HEVs) and electric vehicles (EVs) both hold strong market shares, each offering distinct advantages for various consumer needs. Moreover, the Japanese government’s goal to phase out new gasoline-only vehicles by 2035 emphasizes its commitment to eco-friendly vehicles, supported by incentives and subsidies in line with its 2050 carbon neutrality target.

Current Market Landscape in Japan

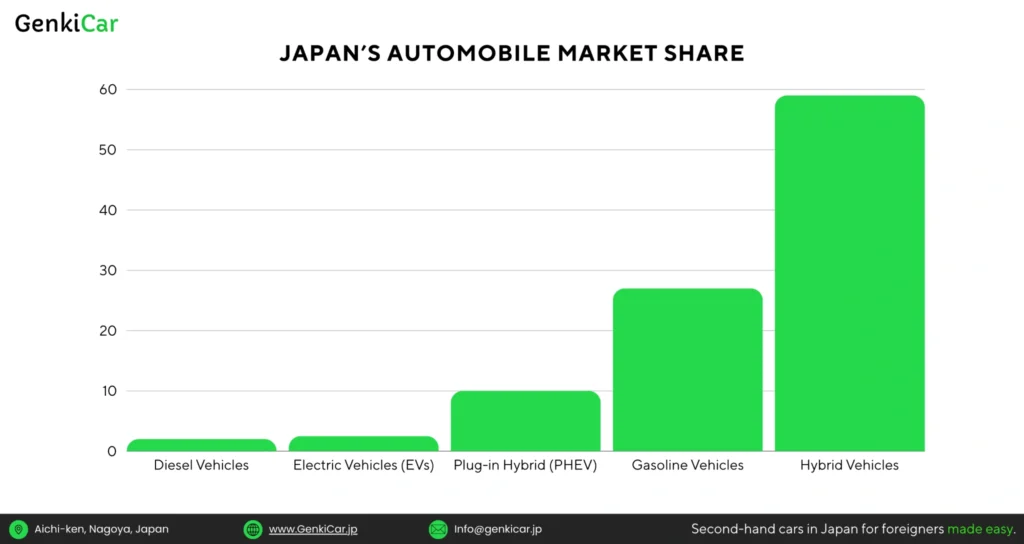

The automotive market in Japan is heavily dominated by hybrids, with leaders like Toyota and Honda capitalizing on their established reputations. Hybrids currently account for approximately 30% of new car sales, showcasing consumer trust in this proven technology. While EVs remain a smaller segment, their presence has steadily increased in urban areas, with market shares growing from 2% to nearly 6% over the past two years.

To support this transition, the Japanese government has introduced a framework of incentives and subsidies for both hybrid and electric vehicles, alongside policies favoring cleaner technologies. This combination of governmental support and expanding eco-friendly vehicle options is reshaping Japan’s auto market, with major manufacturers such as Nissan and Toyota introducing a diverse range of models tailored to various market segments.

Here’s a graph showing Japan’s automobile market share as of 2024 :

Comparative Analysis

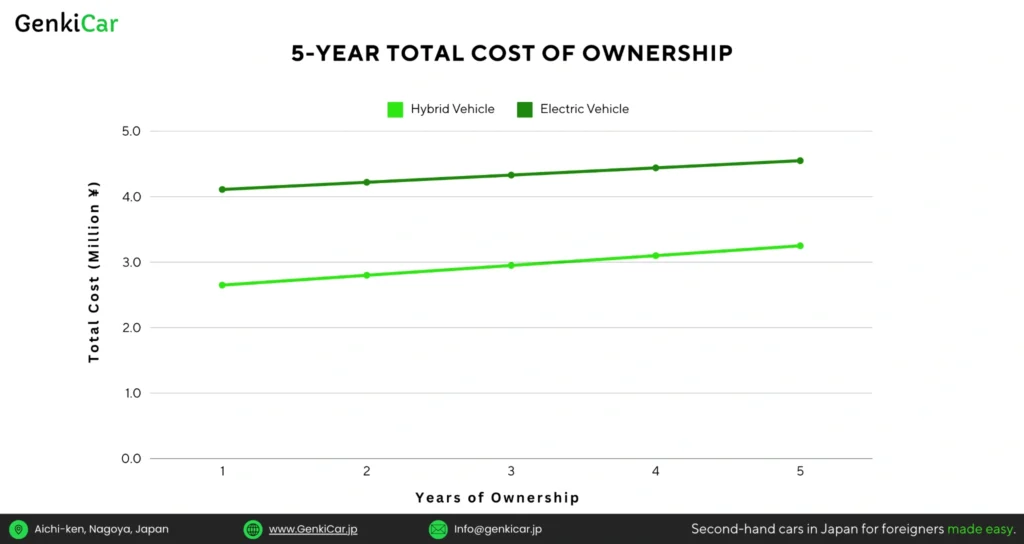

The initial purchase price for hybrids in Japan typically ranges from ¥2,000,000 to ¥3,500,000, while electric vehicles generally start at ¥3,500,000 and can exceed ¥10,000,000 for premium models. Government subsidies significantly offset these costs, with EVs eligible for up to ¥800,000 and hybrids qualifying for up to ¥400,000 in financial aid.

For example, Toyota’s Prius Hybrid starts at around ¥2.5 million, while Nissan’s LEAF EV begins at approximately ¥4 million. This financial support reduces the entry cost gap, making EVs increasingly competitive with hybrids. Long-term maintenance costs tend to favor EVs due to fewer moving parts, requiring less regular service. Conversely, hybrids, while mechanically more complex, benefit from Japan’s extensive service infrastructure, where battery replacement costs are generally lower than those for EVs.

Want to check out electric or hybrid cars in Japan? Complete our form to get connected with a dealership knowledgeable in eco-friendly models for foreigners.

Here’s a graph showing the 5-year total cost of ownership for Hybrid vs Electric Cars in Japan:

Infrastructure and Accessibility

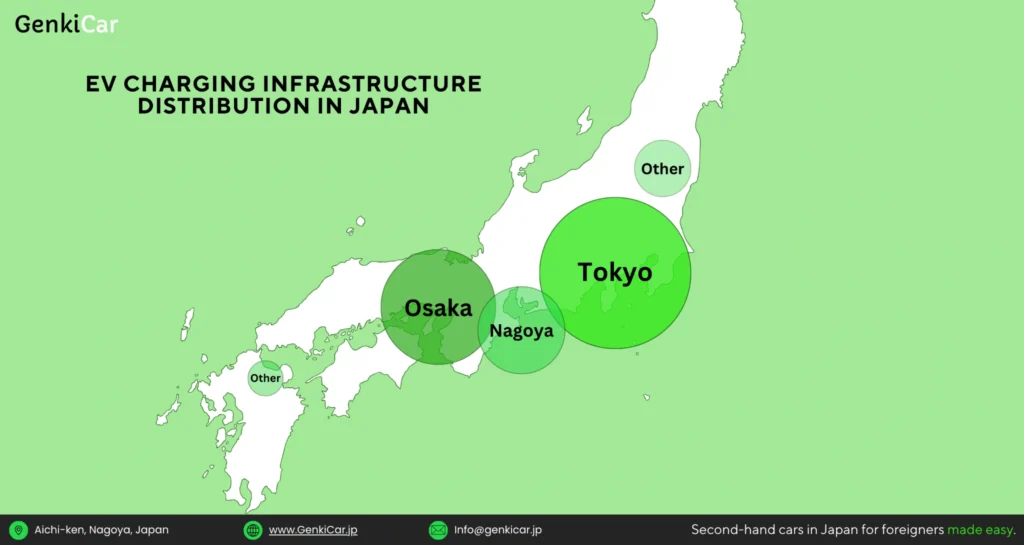

Japan boasts one of the world’s most comprehensive charging networks, with over 40,000 public charging stations, primarily concentrated in urban areas. Major cities like Tokyo, Nagoya and Osaka have dense charging networks, with convenience stores and parking facilities often providing access to chargers. Hybrid vehicles continue to benefit from Japan’s extensive network of fuel stations, offering flexibility for both urban and long-distance travel.

The EV charging network continues to expand, with initiatives underway to install high-speed charging stations along highways and in rural regions. Workplace charging solutions are becoming more common, with numerous Japanese corporations investing in on-site facilities as part of their sustainability goals. These developments are particularly beneficial for EV drivers in rural areas, where infrastructure expansion is underway.

Here’s a map showing Electric Cars Infrastructure Distribution In Japan:

Performance and Technology

Electric vehicles offer superior acceleration and smoother operation, with many models capable of achieving 0-100 km/h in under 7 seconds. Most current EVs offer a range of 300-500 km per charge, while hybrids—combining gasoline and electric power—provide ranges exceeding 1,000 km on a single tank, making them especially suitable for long-distance travel.

For instance, the Nissan Ariya provides up to 450 km per charge, while hybrids like the Toyota Aqua exceed 1,000 km with a fully charged battery and a tank of fuel. EVs typically take 30-40 minutes to reach an 80% charge at high-speed stations, whereas hybrids refuel in minutes, which is particularly advantageous during peak travel periods and emergencies.

Environmental Impact

Both vehicle types contribute substantially to reducing carbon emissions, though their environmental impact depends on energy sources. EVs operate with zero tailpipe emissions, which aligns with Japan’s carbon-neutrality ambitions. However, Japan’s grid still relies significantly on thermal power, meaning EV benefits are partially offset by power generation emissions. As Japan increases its renewable energy capacity, the environmental advantages of EVs are expected to grow.

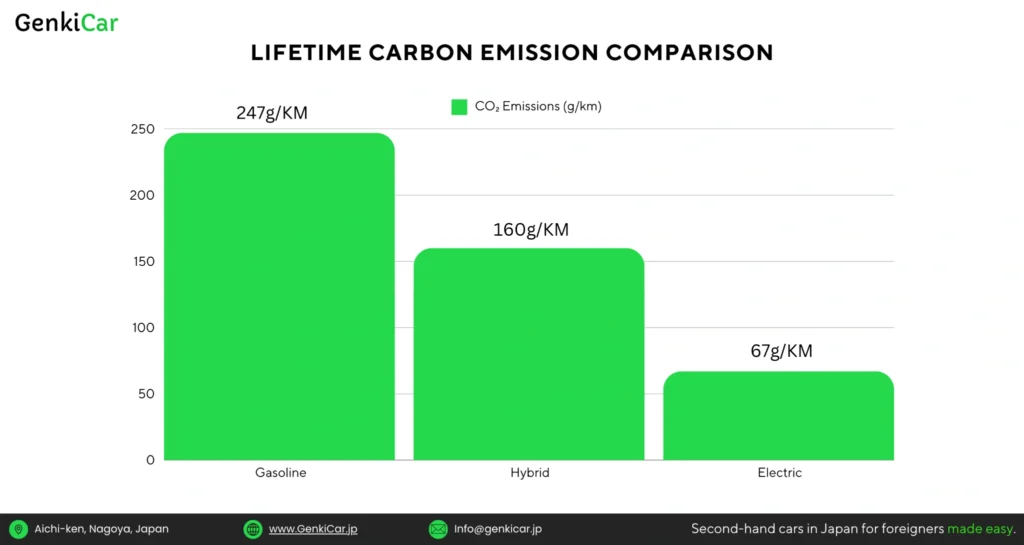

Manufacturing impacts reveal that EV production currently generates higher emissions due to battery manufacturing, but the lifetime environmental impact of EVs generally becomes lower than that of hybrids after approximately 50,000 km of driving. Recycling initiatives for lithium-ion batteries are also progressing, addressing concerns over long-term environmental impacts associated with EV battery disposal.

Below is a graph showing the lifetime carbon emission comparison:

Business Applications

Fleet Management Perspectives

Corporate fleet managers in Japan are increasingly adopting hybrid and electric vehicles, with the choice typically guided by specific use cases. Urban delivery fleets are finding success with EVs, particularly for last-mile delivery services, while hybrids remain popular for sales teams requiring greater range capabilities.

Total Cost of Ownership (TCO) analyses favor EVs for high-mileage urban applications, where lower operating costs offset the higher initial investment. Urban EV fleets, for example, can save up to 25% annually in fuel and maintenance compared to hybrid fleets. However, hybrids are more cost-effective for mixed-use scenarios involving both urban and highway driving, thanks to their extended range and reduced dependency on charging infrastructure.

Market Opportunities

The shift to sustainable vehicles has generated numerous business opportunities across Japan. These include:

- Installation and maintenance of charging infrastructure

- Battery recycling and second-life applications

- Fleet management software specialized for hybrid and electric vehicles

- Integration of vehicle charging with building energy management systems

The market for EV infrastructure and battery recycling is expected to grow by over 15% annually, providing substantial opportunities for companies invested in these areas.

Regional Considerations

Urban Areas

In Tokyo and other major cities, EV owners benefit from designated parking, discounted highway tolls, and exemptions from specific traffic restrictions. Dense urban charging networks make EV ownership particularly feasible in cities, while hybrids offer the advantage of flexible refueling and consistent reliability in stop-and-go traffic.

Rural Regions

Rural areas present unique challenges for EV adoption due to underdeveloped charging infrastructure. Hybrids maintain a significant advantage in these areas, offering the reliability of dual power sources and widespread service availability. However, government-led projects are actively working to address these infrastructure gaps, with plans to install fast chargers along major rural routes by 2025, which could improve EV feasibility in rural areas.

Future Outlook

The future of Japan’s automotive industry points toward continued growth in both hybrid and electric vehicle segments. Technological advancements are expected to drive down costs and enhance performance. Japanese automakers, including Toyota and Honda, are pioneering innovations in solid-state batteries, promising longer ranges and faster charging by 2027. Expanded integration of renewable energy with charging networks and developments in wireless charging and vehicle-to-grid (V2G) systems will further support the transition to eco-friendly transport.

Frequently Asked Questions (FAQ)

- What are the main differences between hybrid and electric vehicles in Japan?

- Hybrids combine gasoline and electric power for flexibility and extended range, while EVs rely solely on battery power, offering zero direct emissions and lower running costs.

- Which option is more cost-effective for Japanese businesses?

- For high-mileage, urban-focused fleets, EVs are generally more cost-effective despite higher upfront costs. Hybrids are more economical for mixed-use or areas with limited charging.

- How extensive is Japan’s charging infrastructure?

- Japan has over 40,000 public charging stations, mainly concentrated in urban areas, with ongoing expansion into rural regions and along major highways.

- What government incentives are available for hybrids and EVs?

- Current incentives include up to ¥800,000 in purchase subsidies for EVs and ¥400,000 for hybrids, alongside tax breaks and local incentives like reduced parking fees.

- How do weather conditions affect hybrid vs. electric vehicle performance?

- Cold weather reduces EV range by 20-30%, while hybrids maintain more consistent performance across temperature changes.

- What are the maintenance requirements for each type?

- EVs generally require less maintenance due to fewer moving parts, whereas hybrids need regular servicing for both gasoline and electric components.

- Which manufacturers lead in hybrid and EV technology in Japan?

- Toyota is a leader in hybrid technology with its Hybrid Synergy Drive, while Nissan has established a strong EV lineup with models like the LEAF.

- How do resale values compare between hybrids and EVs?

- Hybrids currently maintain higher resale values, benefiting from market familiarity and proven reliability, though EV values are improving as technology matures.

Conclusion

The choice between hybrid vehicles and electric vehicles in Japan depends on various factors including usage patterns, infrastructure access, and specific needs. While hybrid vehicles currently offer greater flexibility and proven reliability, electric vehicles are rapidly gaining ground with improving technology and expanding infrastructure. Businesses and consumers should carefully evaluate their specific requirements before buying a car, considering factors such as daily range needs, charging access, and total cost of ownership when making their choice. As Japan continues its transition toward sustainable transportation, both hybrid and electric vehicles will play crucial roles in achieving the nation’s environmental goals while meeting diverse mobility needs.